Is your SWILAF Beneficiary up-to-date?

This website is designed to provide educational information on the Southwestern Illinois Laborers’ Annuity Fund (SWILAF).

Download & Print Forms

Use this section to locate the required forms and resources associated with the Southwestern Illinois Annuity Fund. For best results download the form to your PC and then open the form on your PC.

Beneficiary Designation

Use this form to assign your beneficiary. This form should always be kept current with the beneficiary of your choice.

Change of Address

Complete this form to update your address on file with SWILAF. Always make sure your current address is on file.

Plan Summary

The summary plan explains the provisions of the southwestern Illinois Annuity Plan. *SWILAF Plan Effective January 1, 2019

Withdrawal Form-Draft

To request a withdrawal you must call the office. This withdrawal form is purely informational.

Hardship Distribution

All hardship applicants must fill out this form for consideration of an annuity hardship distribution.

Physician’s Statement

This Total and Permanent Disability form needs to be completed by the attending Physician.

Lump Sum Tax Notice

This notice contains important information for your review before you decide how to receive your benefits.

Waiver of Survivor Annuity

This form must be completed if the participant has elected not to receive the Qualified Preretirement Survivor Annuity.

QDRO

The Qualified Domestic Relations Order (draft) is needed in the event of divorce or legal separation.

Trustees & Partners

Board of Trustees

Union Trustees

Mr. Eric Oller

Mr. Gregory Kipping

Mr. Brandon Royer

Fund Administrator

Rick Schewe

Legal Counsel

Britt W. Sowle, Esq.

Cavanagh & O’Hara, LLP

101 West Vandalia Street, Suite 245

Edwardsville, Illinois 62025

Employer Trustees

Mr. Eugene Keeley

Mr. Kirk Sonnenberg

Mr. David Baxmeyer

Actuary and Consultant

The Segal Company

Auditor

Romolo & Associates

From the Desk of the Trustees

This website was developed to better serve your questions that may arise, while keeping in contact with the fund office.

Current addresses, phone numbers, email addresses, and beneficiary information is essential to better serve you.

Some forms provided on this site are at your fingertips to fill out and return to this office, while other are samples for information only. You would need to contact the fund office to obtain an original set mailed to you.

If you have any questions, please contact the fund office, or email it to us, using the area of this site provided.

Thank you for your patience!

Respectfully,

SWILAF Fund Trustees

Frequently Asked Questions

The questions and answers which follow are meant to give you an outline of how the Annuity Plan works. It is not possible to cover all the Plan provisions in these questions and answers, but they will give you an overview of the program. The Plan Rules and Regulations govern a participant’s rights to benefits. You should refer to the full text of these rules in order to determine your rights under the Annuity Plan. The full text of the rules is located in the Annuity Plan Document.

How do I know if I am a participant in the Annuity Plan?

After you commence to work for an employer who is signatory to a Collective Bargaining Agreement or Participation Agreement requiring an Annuity Plan contribution to be made on your behalf, you will become a Participant in the Plan upon completion of two hundred (200) hours of work or upon $200.00 in contributions credited to your Individual Account. At this point, you are entitled to the full value of your account upon retirement, disability, death, or separation from service.

Who pays contributions into the Annuity Plan?

The contributions to the Annuity Plan are contributed by employers who have signed a Collective Bargaining Agreement with the Laborers’ International Union of North America, an affiliated Local Union, or other entities (including a Local Union or any related Funds) who have signed other agreements that require contributions to the Plan. No employee contributions are permitted.

Who pays the cost of the Annuity Plan?

The entire cost of the Annuity Plan is paid for by employer contributions. The minimum employer contribution rate is defined within your employer’s collective bargaining agreement with the Union or participation agreement with the Annuity Plan. No employee contributions are permitted.

Who administers the Annuity Plan?

The Plan is administered by its Board of Trustees. As Plan Administrator, the Trustees interpret the Plan to determine what benefits and when benefits are payable to the Participants if they retire, die, become disabled, suffer qualifying hardship or otherwise terminate employment. They are also responsible for keeping the Plan’s records and answering any questions you may have about the Plan, and your benefits and rights under the Plan.

How much is the Annuity Benefit?

The amount of the annuity benefit for each Participant is the amount in each Participant’s Individual Account at the time the Participant qualifies for payment of the annuity. Generally, it is the sum of all contributions made over the years to a Participant’s Individual Account, plus the interest earned, minus a charge for administration expenses.

When will I receive payments from the Annuity Plan?

In general, you are eligible to receive the amount in your Individual Account when:

- You are receiving a pension from a LIUNA affiliated Pension Plan, or

- You become totally and permanently disabled. If you become totally and permanently disabled, then you may apply to receive your total Account Balance regardless of your age. You will be considered to be totally and permanently disabled if the Trustees determine, on the basis of medical evidence, that you are permanently incapable of working due to a physical or mental disability. You must also have earned at least one year of service (at least 200 hours of service or $200.00 in contributions paid into the Fund on your behalf during any Plan Year prior to becoming disabled); or

- You have had no employer contributions to the Annuity Plan made on your behalf for 12 consecutive months, or

- You have left covered employment and entered the Armed Forces of the United States for a period of at least 90 days, or

- You reach age 72 regardless as to whether you are working in covered employment. (Federal law requires that the distribution begin by April 1 following the end of the year in which you reach age 72.)

- In the event of a financial hardship which makes a distribution necessary in light of a participant’s immediate and heavy financial need, a Participant may apply for an in-service withdrawal of a portion of the Participant’s Individual Account.

Contact Us

Contact Details

Mr. Rick Schewe

Fund Administrator

Phone

(618) 233-4121

Fax

(618) 233-4737

Mailing Address

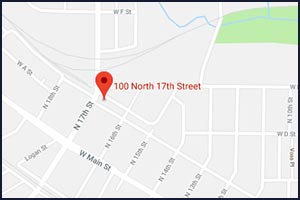

100 North 17th Street

Belleville, Illinois 62226

Still Have Questions?

If you have a question regarding the Southwestern Illinois Laborers’ Annuity Fund please fill out this form or call us at (618) 233-4121.